is property tax included in mortgage ontario

When paying EAT all assets owned by the deceased which form part of the deceaseds estate that is subject to probate in Ontario must be included see below for exclusions. There is a maximum credit of 200 for an individual or 400 for a family.

A Beginner S Guide To Mortgages Beginners Guide Mortgage Mortgage Loans

Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

. In the US the Federal government created several programs or government sponsored. Requisitions for amounts on business property. The small business tax subclass will provide a 15 per cent reduction in the commercial tax rate for eligible properties.

The Estate Administration Tax is based on the value of the estate which is the value of all assets owned by the deceased at the time of death. Waterloo is a city in the Canadian province of OntarioIt is one of three cities in the Regional Municipality of Waterloo formerly Waterloo CountyWaterloo is situated about 94 km 58 mi southwest of TorontoDue to the close proximity of the city of Kitchener to Waterloo the two together are often referred to as KitchenerWaterloo or the Twin Cities. A property that is a taxable Canadian property solely because a provision of the Income Tax Act deems it to be a taxable Canadian property.

These need to be included in the calculations while filing your taxes and reduce your final tax liability. Most of the time your lender will collect property tax in your mortgage payment then pay your municipality on your behalf. Read on to learn when you pay your property taxes through your mortgage.

Often a property tax is levied on real estate. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Powers of municipality levying rates.

The cost of the propertys mortgage may also be included in the monthly fee. If you received a refund or rebate in 2021 of real estate taxes you paid in 2021 reduce your deduction by the amount of the refund or rebate. Todays national mortgage rate trends.

The picture changes if you continue to use and occupy the house after having made the sale for 1. The process begins when the purchaser makes an offer which is irrevocable for a certain time. All real estate in Ontario minus the value of any encumbrances on that real estate encumbrance mortgage or lien.

What must be included in estate assets. The IRS takes the position that your continued occupancy of the property was part of the deal. How Is Rental Income Taxed in Ontario.

A property that is inventory of a business carried on in Canada other than real or immovable property situated in Canada a Canadian resource property or a timber resource property a security that is. Your continued occupancy of the residence causes the whole value of the property to be included in your gross estate and subject to estate tax. Sometimes Toronto for.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Difference in amounts levied and collected. This can be a national government a federated state a county or geographical region or a municipalityMultiple jurisdictions may tax the same property.

Ontario is a great place to live and work but many people dont know that it also has some of the highest taxes in all of Canada. 527 Residential Rental Property. However there are some times when this is not ideal.

If youre a corporation or business owner with rental property here- be aware. Mortgage interest deductions in Canada enable. That your total tax rate will range from 11 for those who qualify up to 38.

If your mortgage payment included just principal and interest you could use a bare-bones. Residential property distribution of amounts levied. In the Agreement the buyer agrees to purchase the property for a certain price provided that a number of terms and conditions are satisfied.

With a 20 down payment on a 30-year mortgage and a 4 interest rate you need a household income of 70000 yearly or more before tax. Regulations Minister of Finance. This lets us find the most appropriate writer for any type of assignment.

For today Tuesday September 06 2022 the current average rate for the benchmark 30-year fixed mortgage is 605 up 16 basis points since the same time. When you take out a mortgage you agree to pay the principal and interest over the life of the loan. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders.

How much income you need depends on your down payment loan terms taxes and insurance. The most current Ontario mortgage rates are already included in the calculator above so you can trust the numbers we provide to be accurate. See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed.

1 online tax filing solution for self-employed. The province allows Ontario municipalities to charge a vacant home tax on residential properties with six units or less large apartment buildings for example arent included. If you didnt use any of the proceeds of any mortgage included on line 12 of the worksheet for business investment or other deductible activities then all the interest on line 16 is personal interest.

An Agreement of Purchase and Sale is a written contract between a seller and a buyer for the purchase and sale of a particular property. Estimate your provincial taxes with our free Ontario income tax calculator. Ontario sales tax on CMHC insurance When applicable the cost of CMHC insurance is added to your mortgage balance and paid off over the amortization of your mortgage.

New for 2022 Small Business Tax Subclass. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. The introduction of the small business tax subclass offers property tax relief to small businesses who meet the eligibility criteria.

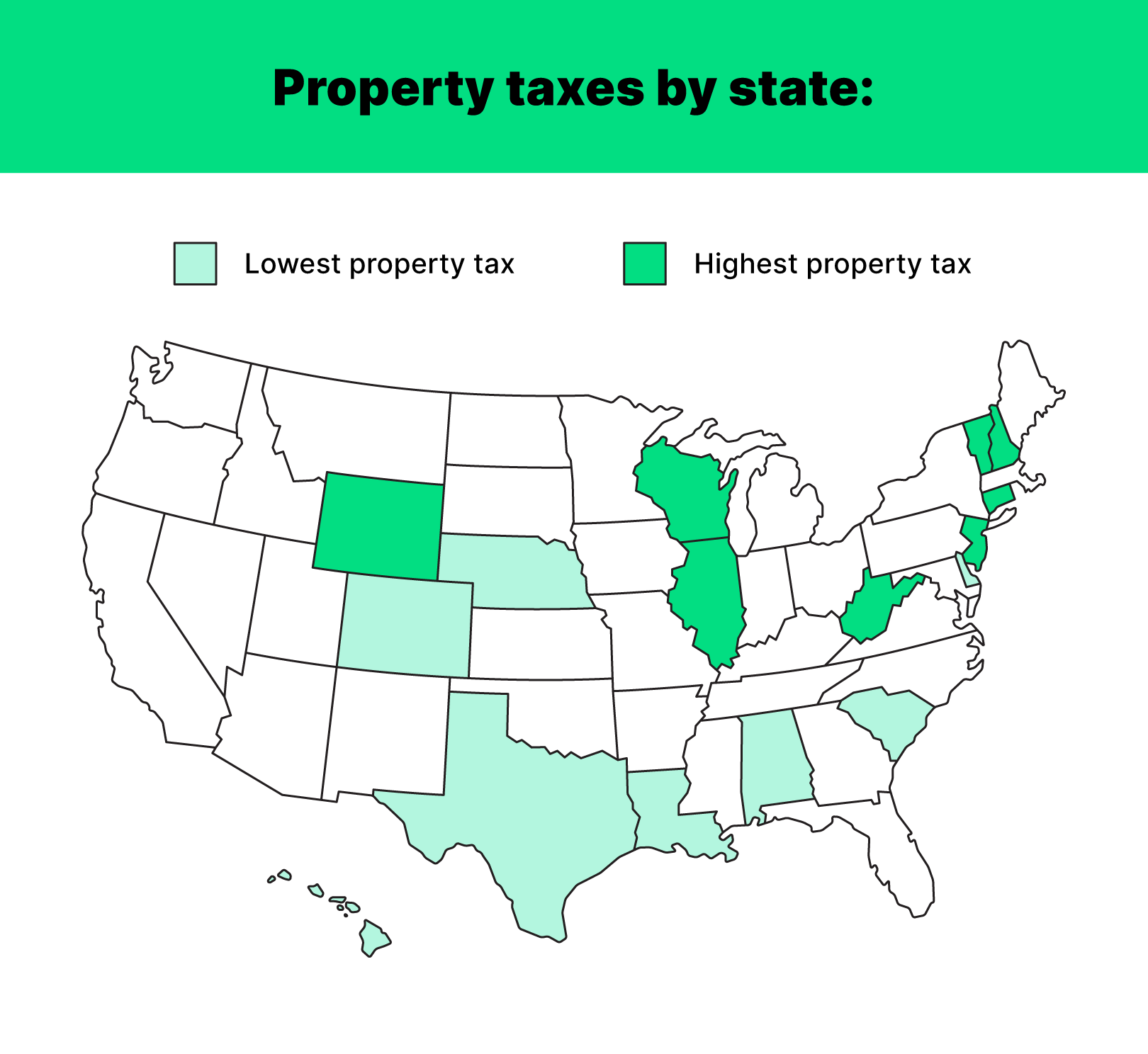

Americas 1 tax preparation provider. Ontario residents can receive a 20 tax credit for local accommodation expenses. The tax is levied by the governing authority of the jurisdiction in which the property is located.

Personal interest isnt deductible. Are school taxes included in your mortgage property taxes. When amounts paid to boards.

Real estate in Ontario less encumbrances such as a mortgage collateral mortgage or. 530 Tax Information for Homeowners. 2021 Property Tax Rates 2020 Property Tax Rates 2019 Property Tax Rates.

Even if an individual tenant has paid off their share of the loan its possible for the building itself to have a. State or local law determines whether and when a property tax is assessed which is generally when the taxpayer becomes liable for the property tax imposed. Eligible expenses include leisure trips at a location such as a hotel bed-and-breakfast or resort in Ontario.

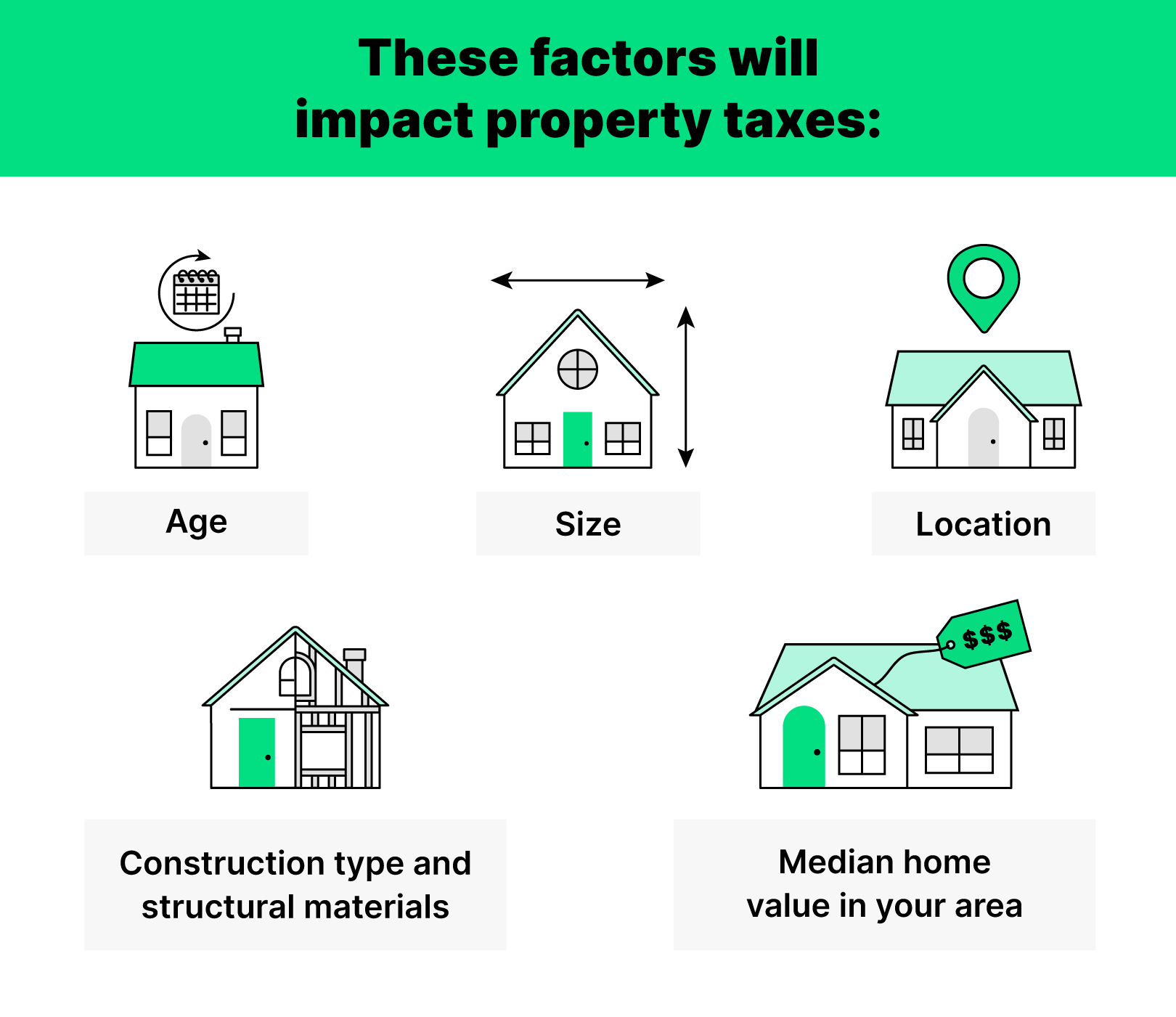

A property tax or millage rate is an ad valorem tax on the value of a property. School tax rates for commercial and. Average property tax in New York counties.

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Your Guide To Property Taxes Hippo

Paying Property Tax In Canada Nerdwallet

Ontario Property Tax Rates Calculator Wowa Ca

Do I Have To Pay Property Taxes Through My Mortgage Ratesdotca

Property Tax How To Calculate Local Considerations

How To Assess The End Costs In Ottawa Ontario Closing Costs Mortgage Loans Mortgage

Idbi Bank Home Loan Offers Flexible Loan Repayment Options And Lower Emis At Attractive Interest Rates Calculate Your E Home Loans Loan Home Improvement Loans

Your Guide To Property Taxes Hippo

Should You Pay Property Taxes Through Your Mortgage Loans Canada

Uk Property Tax Below European Average News Forth Capital Mortgage Loan Calculator Mortgage Loan Originator Mortgage Amortization Calculator

Should You Pay Property Taxes Through Your Mortgage Ratehub Ca

Your Guide To Property Taxes Hippo

Paying Property Taxes Avoid A Big Bill Options To Make It Easier My Money Coach

Mortgage The Components Of A Mortgage Payment Wells Fargo

Trend Shows Home Price Growth At Record High Rising At Fastest Pace Since Early 2000s Refinance Mortgage Mortgage Rates Mortgage